Financial mathematics: Plan and describe how to manage finances of social clubs

Unit 1: Financial control for social clubs

Natashia Bearam-Edmunds

Unit 1 outcomes

By the end of this unit you will be able to:

- Calculate operating expenses.

- Draw up a yearly budget.

- Use given information to record actual income and expenditure for a year.

- Compare actual income and expenses to the projected budget figures.

- Identify variances and provide possible corrective actions to be taken to control future finances of the club.

What you should know

There is no prior learning required for this unit.

Introduction

In this unit we are going to learn about the finances involved in social clubs. Social clubs are membership organisations that are maintained mainly by fees paid by its members, from donations, from fundraising or grants. As these clubs are generally formed by like-minded people with a common interest or activity, they are allowed to limit their membership. There are many different types of social clubs in existence. Burial societies, book clubs, sports clubs, country clubs, Christian fellowships and gaming clubs are all examples of social clubs. Stokvels are social groups in which individuals regularly contribute a fixed amount of money into a common pool, taking turns on a rotational basis to use a lump sum for individual purpose.

Here are some of the common terms that you will need to be familiar with.

Income is the money received in exchange for goods or services. In social clubs income is received from membership fees and donations, for example.

An expense is a cost that is incurred.

A budget is a financial plan that shows expected income and expenses over a certain period.

Profit is money you are left with after deducting all expenses.

[latex]\scriptsize \text{profit}=\text{income}-\text{expenses}[/latex]

If expenses are greater than income, then a financial loss is incurred.

Financial management

The size of the club will determine the financial management processes that are needed. A management committee elected by club members will ensure that the club has good financial management processes in place to achieve its objectives.

Generally a treasurer, who is appointed by the club’s members or management committee, will be responsible for the financial management of the club.

A simple computer accounting package may be used to keep track of the club’s finances, however, if the club is small enough a manual system is sufficient.

The treasurer must keep track of:

- expenses

- income

- cash flow

- profit or loss

- necessary financial adjustments

- banking, bookkeeping and record keeping

- fundraising and ensuring appropriate use of funds

- tax considerations if applicable

- annual budget.

The club will have its own bank account where membership fees, donations, etc. can be deposited.

A cashbook is a journal in which all of the club’s receipts and payments are recorded. Cash includes money, credit card slips, electronic payments and money orders. The details of all transactions should be recorded in the cashbook.

Budgets

Annual budgets are an important part of planning and organising the financial resources of a social club. Usually the treasurer will set up the annual budget.

A budget shows how much income the club expects to receive during the next financial year, how much the club expects to spend in the next financial year, and the predicted surplus (profit) or deficit (loss) for the budget period.

Once the budget is approved it is added to the accounting system so that it can be compared to the club’s actual income and expenses for the year.

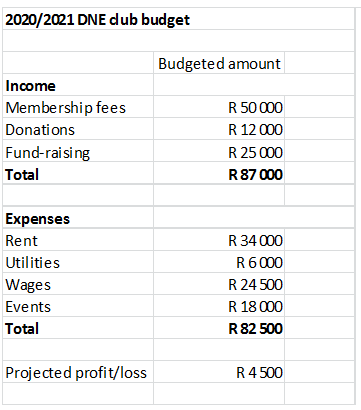

Figure 1 gives an example of a club’s annual budget.

Looking at Figure 1, we can calculate that the projected profit for the year for the DNE club is: [latex]\scriptsize \text{R87 0}00-\text{R82 }500=\text{R}4\text{ }500[/latex].

Recording income and expenditure

The treasurer must regularly compile reports on the financial situation of the club so that actual performance can be compared against the budget.

The profit and loss statement, also referred to as the income and expenditure statement, is a summary of a club’s income and expenses over a specific period of time and shows how much money a club has made or lost as a result of its operations. Losses are sometimes shown in red on the statement.

The income and expenditure statement is prepared at regular intervals (usually monthly and at the financial year end) to show the results of operations for a given period. This statement is important for clubs, as it shows how received funds have been allocated against operating expenses during the reporting period.

Income

Clubs receive most of their income from membership fees, grants and donations. These are often referred to as ‘contributions’. Some clubs may also receive income from trading activities, such as the sale of branded goods or goods produced from workshop activities.

Each source of income should be disclosed in the financial statement. Where income is received with specific conditions about how it is to be used, these conditions should be reported through the financial statements.

Expenses

For a complete financial picture of the club, all income must be matched against the expenses incurred during the reporting period. Expenses include rent, salaries, utilities (such as water and electricity), gifts, social functions, catering, and other operating expenses.

Variance

Variance is a method used to compare actual financial performance to budgeted expectations. Variance can be shown as percentages or monetary differences.

If the variance amount is about the same as what is budgeted for, then no action needs to be taken.

A budget variance is positive, or favourable, when the income results are higher than the budget expectations. But if actual expenses are greater than expected in the budget, the result is a negative variance.

The formula to calculate variance is:

[latex]\scriptsize \text{variance amount = actual number}-\text{budgeted number}[/latex]

- If income variance is positive, with actual income greater than budgeted (or expected) income, this is favourable.

- If expenditure variance is positive, with actual expenditure greater than budgeted (or expected) expenditure, this is NOT favourable: spending was more than it was expected to be. So, when you see a negative in the variance expense column it is a good thing because it means expenses were less than expected.

Example 1.1

The treasurer of Mpower Club compared the actual income and expenses figures against the projected budget figures at the end of the financial year.

| ITEM | BUDGETED () | ACTUAL (ZAR) | VARIANCE (ZAR) |

| INCOME | |||

| Membership fees | [latex]\scriptsize 35\text{ }000[/latex] | [latex]\scriptsize \text{42 }000[/latex] | A |

| Income from sales | [latex]\scriptsize 5\text{ }000[/latex] | B | [latex]\scriptsize -500[/latex] |

| Donations | [latex]\scriptsize \text{12 }000[/latex] | [latex]\scriptsize \text{6 }000[/latex] | C |

| Total | [latex]\scriptsize \text{52 }000[/latex] | [latex]\scriptsize \text{52 5}00[/latex] | [latex]\scriptsize \text{5}00[/latex] |

| . | |||

| EXPENSES | |||

| Club rental | [latex]\scriptsize \text{15 }000[/latex] | [latex]\scriptsize \text{15 }000[/latex] | [latex]\scriptsize 0[/latex] |

| Wages | D | [latex]\scriptsize \text{7 }000[/latex] | [latex]\scriptsize \text{2 }000[/latex] |

| Social events | [latex]\scriptsize \text{32 }000[/latex] | [latex]\scriptsize \text{38 }000[/latex] | [latex]\scriptsize \text{6 }000[/latex] |

| Utilities | [latex]\scriptsize \text{1 5}00[/latex] | [latex]\scriptsize \text{1 }000[/latex] | E |

| Total | [latex]\scriptsize \text{57 5}00[/latex] | [latex]\scriptsize \text{61 0}00[/latex] | [latex]\scriptsize \text{3 5}00[/latex] |

| . | |||

| Surplus/deficit | [latex]\scriptsize -\text{5 5}00[/latex] | F |

- Complete the table by filling in the missing amounts for letters A to F.

- Did Mpower perform better financially than expected?

- List one possible way to decrease the club’s deficit.

Solution

- .

[latex]\scriptsize \begin{align*}\text{A}&=42\text{ }000-35\text{ }000\\&=7\text{ }000\end{align*}[/latex]

[latex]\scriptsize \begin{align*}\text{B}&=5\text{ }000+(-500)\\&=4\text{ 5}00\end{align*}[/latex]

[latex]\scriptsize \begin{align*}\text{C}&=6\text{ }000-12\text{ }000\\&=-6\text{ }000\end{align*}[/latex]

[latex]\scriptsize \begin{align*}\text{D}&=7\text{ }000-2\text{ }000\\&=5\text{ }000\end{align*}[/latex]

[latex]\scriptsize \begin{align*}\text{E}&=1\text{ }000-1\text{ 5}00\\&=-500\end{align*}[/latex]

[latex]\scriptsize \begin{align*}\text{F}&=42\text{ }000+4\text{ }500+6\text{ }000-(15\text{ }000+7\text{ }000+38\text{ }000+1\text{ }000)\\&=-8\text{ }500\end{align*}[/latex] - Mpower performed worse than expected with an additional [latex]\scriptsize \text{R3 }000[/latex] loss over what was budgeted for.

- The club can reduce the costs by hosting fewer social functions.

Example 1.2

Ali manages the finances of the So we Sew Club. She is compiling the income and expenditure sheet for the club. Below are the transactions for the month. Use the following information to draw up the profit and loss statement.

| Opening balance | [latex]\scriptsize \text{R}0[/latex] |

| Rent | [latex]\scriptsize \text{R2 }000[/latex] |

| Membership fees | [latex]\scriptsize \text{R100}[/latex] per member for [latex]\scriptsize 30[/latex] members |

| Sponsorships | [latex]\scriptsize \text{R3 }000[/latex] |

| Purchase of knitting needles | [latex]\scriptsize \text{R6}00[/latex] |

| Transport costs | [latex]\scriptsize \text{R1 }000[/latex] |

| Tea and coffee | [latex]\scriptsize \text{R5}00[/latex] |

| PROFIT & LOSS STATEMENT SO WE SEW |

|

| INCOME | AMOUNT |

| Opening balance | [latex]\scriptsize \text{R}0[/latex] |

| . | |

| . | |

| TOTAL INCOME | |

| . | |

| EXPENDITURE | AMOUNT |

| . | |

| . | |

| . | |

| TOTAL EXPENDITURE | |

| SURPLUS/DEFICIT | |

Solution

We identify the income items: membership fees and sponsorships.

We identify the expense items: rent, knitting needles, transport costs, and tea and coffee.

Once you have identified which items fall under income and which are expenses you can complete the profit and loss statement.

| PROFIT & LOSS STATEMENT SO WE SEW |

|

| INCOME | AMOUNT |

| Opening balance | [latex]\scriptsize \text{R}0[/latex] |

| Membership fees | [latex]\scriptsize \text{R}100\times 30=\text{R}3\text{ }000[/latex] |

| Sponsorships | [latex]\scriptsize \text{R3 }000[/latex] |

| TOTAL INCOME | [latex]\scriptsize \text{R6 }000[/latex] |

| . | |

| EXPENDITURE | AMOUNT |

| Rent | [latex]\scriptsize \text{R2 }000[/latex] |

| Purchase of knitting needles | [latex]\scriptsize \text{R6}00[/latex] |

| Transport costs | [latex]\scriptsize \text{R1 }000[/latex] |

| Tea and coffee | [latex]\scriptsize \text{R5}00[/latex] |

| TOTAL EXPENDITURE | [latex]\scriptsize \text{R4 1}00[/latex] |

| SURPLUS/DEFICIT | [latex]\scriptsize \text{R1 9}00[/latex] |

Exercise 1.1

- Siya is the financial secretary for the local church club. Use the information presented to complete the income and expenditure statement for the club.

Balance brought forward [latex]\scriptsize \text{R1 500}[/latex] Sponsorship from local businesses [latex]\scriptsize \text{R1 5}00[/latex] Contribution from church board [latex]\scriptsize \text{R}5\text{ }000[/latex] Fundraising [latex]\scriptsize \text{R3 }000[/latex] Gifts to children’s home [latex]\scriptsize \text{R9}00[/latex] Transport costs [latex]\scriptsize \text{R1 5}00[/latex] Purchase of bibles [latex]\scriptsize \text{R}1\text{ }500[/latex] PROFIT & LOSS STATEMENT INCOME AMOUNT Balance brought forward . . TOTAL INCOME . EXPENDITURE AMOUNT . . . TOTAL EXPENDITURE SURPLUS/DEFICIT - Leading Ladies is a social club that cares for abandoned children. The club was expected to receive the following amounts of money for the year ended 31/12/2019:

Grant from Lottery [latex]\scriptsize \text{R3}00\text{ }000[/latex] Donations [latex]\scriptsize \text{R}25\text{ }000[/latex] Fees from members [latex]\scriptsize \text{R18 }000[/latex] Total [latex]\scriptsize \text{R3}43\text{ }000[/latex] The club was expected to have the following expenditure for the same year:

Rent [latex]\scriptsize \text{R36 }000[/latex] Stationery [latex]\scriptsize \text{R3 }000[/latex] Baby formula [latex]\scriptsize \text{R89 }000[/latex] Nappies [latex]\scriptsize \text{R76 }000[/latex] Water and electricity [latex]\scriptsize \text{R12 }000[/latex] Wages [latex]\scriptsize \text{R80 }000[/latex] Baby clothes [latex]\scriptsize \text{R32 }000[/latex] Medical expenses [latex]\scriptsize \text{R13 }000[/latex] Total [latex]\scriptsize \text{R34}1\text{ }000[/latex] Listed below is the actual income and expenditure of the club for the year ended 31/12/2019:

.

Actual income:Grant from Lottery [latex]\scriptsize \text{R25}0\text{ }000[/latex] Donations [latex]\scriptsize \text{R5}5\text{ }000[/latex] Fees from members [latex]\scriptsize \text{R20 }000[/latex] Total [latex]\scriptsize \text{R325 }000[/latex] Actual expenditure:

Rent [latex]\scriptsize \text{R36 }000[/latex] Stationery [latex]\scriptsize \text{R2 8}00[/latex] Baby formula [latex]\scriptsize \text{R91 }000[/latex] Nappies [latex]\scriptsize \text{R75 }000[/latex] Water and electricity [latex]\scriptsize \text{R11 2}00[/latex] Wages [latex]\scriptsize \text{R80 }000[/latex] Baby clothes [latex]\scriptsize \text{R29 }000[/latex] Medical expenses [latex]\scriptsize \text{R10 }000[/latex] Total [latex]\scriptsize \text{R335 }000[/latex] - Did the club expect to have a surplus or deficit at the end of the year? What amount were they expecting to have as a surplus or deficit?

- Study the information provided and complete the table below. Write only the answers for each letter A to H.

ITEM BUDGETED (ZAR) ACTUAL (ZAR) VARIANCE (ZAR) INCOME Grant from lottery [latex]\scriptsize 300\text{ }000[/latex] [latex]\scriptsize 250\text{ }000[/latex] A Fees from members [latex]\scriptsize \text{18 }000[/latex] B [latex]\scriptsize +2\text{ }000[/latex] Donations [latex]\scriptsize \text{25 }000[/latex] [latex]\scriptsize \text{55 }000[/latex] C Total [latex]\scriptsize \text{343 }000[/latex] D [latex]\scriptsize -\text{18 0}00[/latex] . EXPENSES Rent [latex]\scriptsize \text{36 }000[/latex] [latex]\scriptsize \text{36 }000[/latex] [latex]\scriptsize 0[/latex] Stationery [latex]\scriptsize \text{3 }000[/latex] [latex]\scriptsize \text{2 8}00[/latex] [latex]\scriptsize \text{+2}00[/latex] Baby formula [latex]\scriptsize \text{89 }000[/latex] [latex]\scriptsize \text{91 }000[/latex] E Diapers [latex]\scriptsize \text{76 }000[/latex] F [latex]\scriptsize \text{+1 }000[/latex] Water and electricity [latex]\scriptsize \text{12 }000[/latex] [latex]\scriptsize \text{11 2}00[/latex] [latex]\scriptsize +800[/latex] Wages [latex]\scriptsize \text{80 }000[/latex] [latex]\scriptsize \text{80 }000[/latex] [latex]\scriptsize 0[/latex] Baby clothes [latex]\scriptsize \text{32 }000[/latex] [latex]\scriptsize \text{29 }000[/latex] [latex]\scriptsize \text{+3 }000[/latex] Medical expenses [latex]\scriptsize \text{13 }000[/latex] [latex]\scriptsize \text{10 }000[/latex] [latex]\scriptsize \text{+3 }000[/latex] Total [latex]\scriptsize \text{34}1\text{ }000[/latex] [latex]\scriptsize \text{335 }000[/latex] [latex]\scriptsize \text{+6 }000[/latex] . Surplus/deficit G H

The full solutions are at the end of the unit.

Summary

In this unit you have learnt the following:

- How social club’s finances are managed.

- How to prepare a profit and loss statement.

- How to complete and compare the annual budget.

- How to calculate the variance between the actual amounts and the budgeted amounts.

Unit 1: Assessment

Suggested time to complete: 20 minutes

- The treasurer of Super Seven Club compared the actual income and expenses figures against the projected budget figures at the end of the financial year. Complete the table by filling in the missing amounts for letters A to J.

ITEM BUDGETED (ZAR) ACTUAL (ZAR) VARIANCE (ZAR) INCOME Membership fees [latex]\scriptsize \text{17 }000[/latex] [latex]\scriptsize \text{12 }000[/latex] A Income from sales [latex]\scriptsize \text{4 }000[/latex] B [latex]\scriptsize +1\text{ }000[/latex] Sponsorship [latex]\scriptsize \text{1 }000[/latex] [latex]\scriptsize \text{1 }000[/latex] C Total D [latex]\scriptsize \text{18 0}00[/latex] [latex]\scriptsize -4\text{ }000[/latex] . EXPENSES Club rental [latex]\scriptsize 0[/latex] [latex]\scriptsize 0[/latex] [latex]\scriptsize 0[/latex] Wages E [latex]\scriptsize \text{2 }000[/latex] [latex]\scriptsize 0[/latex] Functions [latex]\scriptsize \text{4 }000[/latex] [latex]\scriptsize \text{6 }000[/latex] F Gift to orphanage [latex]\scriptsize 0[/latex] [latex]\scriptsize 4\text{ }000[/latex] [latex]\scriptsize \text{4 0}00[/latex] Total G [latex]\scriptsize \text{12 0}00[/latex] H . Surplus/deficit I J - Rachel is the financial secretary of the Women For Change club. Use the information presented to complete the income and expenditure statement for the club.

Opening balance [latex]\scriptsize \text{R3 500}[/latex] Membership fees [latex]\scriptsize \text{R10 5}00[/latex] Income from sales [latex]\scriptsize \text{R8 }000[/latex] Fundraising [latex]\scriptsize \text{R5 }000[/latex] Donation to homeless shelter [latex]\scriptsize \text{R}6\text{ }500[/latex] Transport costs [latex]\scriptsize \text{R1 0}00[/latex] Rent [latex]\scriptsize \text{R4 }500[/latex] PROFIT & LOSS STATEMENT INCOME AMOUNT Opening balance . . . TOTAL INCOME . EXPENDITURE AMOUNT . . . . TOTAL EXPENDITURE SURPLUS/DEFICIT

The full solutions are at the end of the unit.

Unit 1: Solutions

Exercise 1.1

- .

PROFIT & LOSS STATEMENT INCOME AMOUNT Balance brought forward [latex]\scriptsize \text{R1 500}[/latex] Sponsorship from local businesses [latex]\scriptsize \text{R1 5}00[/latex] Contribution from church board [latex]\scriptsize \text{R}5\text{ }000[/latex] Fundraising [latex]\scriptsize \text{R3 }000[/latex] TOTAL INCOME [latex]\scriptsize \text{R11 }000[/latex] . EXPENDITURE AMOUNT Gifts to children’s home [latex]\scriptsize \text{R9}00[/latex] Transport costs [latex]\scriptsize \text{R1 5}00[/latex] Purchase of bibles [latex]\scriptsize \text{R}1\text{ }500[/latex] TOTAL EXPENDITURE [latex]\scriptsize \text{R3 9}00[/latex] SURPLUS [latex]\scriptsize \text{R7 1}00[/latex] - .

- The club expects to have a surplus of [latex]\scriptsize \text{R}2\text{ }000[/latex].

- .

ITEM BUDGETED (ZAR) ACTUAL (ZAR) VARIANCE (ZAR) INCOME Grant from lottery [latex]\scriptsize 300\text{ }000[/latex] [latex]\scriptsize 250\text{ }000[/latex] A [latex]\scriptsize -50\text{ }000[/latex] Fees from members [latex]\scriptsize \text{18 }000[/latex] B [latex]\scriptsize \text{20 }000[/latex] [latex]\scriptsize +2\text{ }000[/latex] Donations [latex]\scriptsize \text{25 }000[/latex] [latex]\scriptsize \text{55 }000[/latex] C [latex]\scriptsize \text{+30 }000[/latex] Total [latex]\scriptsize \text{343 }000[/latex] D [latex]\scriptsize \text{325 }000[/latex] [latex]\scriptsize -\text{18 0}00[/latex] . EXPENSES Rent [latex]\scriptsize \text{36 }000[/latex] [latex]\scriptsize \text{36 }000[/latex] [latex]\scriptsize 0[/latex] Stationery [latex]\scriptsize \text{3 }000[/latex] [latex]\scriptsize \text{2 8}00[/latex] [latex]\scriptsize \text{+2}00[/latex] Baby formula [latex]\scriptsize \text{89 }000[/latex] [latex]\scriptsize \text{91 }000[/latex] E [latex]\scriptsize \text{+2 }000[/latex] Diapers [latex]\scriptsize \text{76 }000[/latex] F [latex]\scriptsize \text{75 }000[/latex] [latex]\scriptsize \text{+1 }000[/latex] Water and electricity [latex]\scriptsize \text{12 }000[/latex] [latex]\scriptsize \text{11 2}00[/latex] [latex]\scriptsize +800[/latex] Wages [latex]\scriptsize \text{80 }000[/latex] [latex]\scriptsize \text{80 }000[/latex] [latex]\scriptsize 0[/latex] Baby clothes [latex]\scriptsize \text{32 }000[/latex] [latex]\scriptsize \text{29 }000[/latex] [latex]\scriptsize \text{+3 }000[/latex] Medical expenses [latex]\scriptsize \text{13 }000[/latex] [latex]\scriptsize \text{10 }000[/latex] [latex]\scriptsize \text{+3 }000[/latex] Total [latex]\scriptsize \text{34}1\text{ }000[/latex] [latex]\scriptsize \text{335 }000[/latex] [latex]\scriptsize \text{+6 }000[/latex] . Surplus/deficit G [latex]\scriptsize +2\text{ }000[/latex] H [latex]\scriptsize -10\text{ }000[/latex]

Unit 1: Assessment

- .

ITEM BUDGETED (ZAR) ACTUAL (ZAR) VARIANCE (ZAR) INCOME Membership fees [latex]\scriptsize \text{17 }000[/latex] [latex]\scriptsize \text{12 }000[/latex] A [latex]\scriptsize -5\text{ }000[/latex] Income from sales [latex]\scriptsize \text{4 }000[/latex] B [latex]\scriptsize 5\text{ }000[/latex] [latex]\scriptsize +1\text{ }000[/latex] Sponsorship [latex]\scriptsize \text{1 }000[/latex] [latex]\scriptsize \text{1 }000[/latex] C [latex]\scriptsize 0[/latex] Total D [latex]\scriptsize \text{22 }000[/latex] [latex]\scriptsize \text{18 0}00[/latex] [latex]\scriptsize -4\text{ }000[/latex] . EXPENSES Club rental [latex]\scriptsize 0[/latex] [latex]\scriptsize 0[/latex] [latex]\scriptsize 0[/latex] Wages E [latex]\scriptsize \text{2 }000[/latex] [latex]\scriptsize \text{2 }000[/latex] [latex]\scriptsize 0[/latex] Functions [latex]\scriptsize \text{4 }000[/latex] [latex]\scriptsize \text{6 }000[/latex] F [latex]\scriptsize \text{+2 }000[/latex] Gift to orphanage [latex]\scriptsize 0[/latex] [latex]\scriptsize 4\text{ }000[/latex] [latex]\scriptsize \text{4 0}00[/latex] Total G [latex]\scriptsize \text{6 }000[/latex] [latex]\scriptsize \text{12 0}00[/latex] H [latex]\scriptsize 6\text{ }000[/latex] . Surplus/deficit I [latex]\scriptsize \text{+16 }000[/latex] J [latex]\scriptsize \text{+6 }000[/latex] - .

PROFIT & LOSS STATEMENT INCOME AMOUNT Opening balance [latex]\scriptsize \text{R3 500}[/latex] Membership fees [latex]\scriptsize \text{R10 5}00[/latex] Income from sales [latex]\scriptsize \text{R8 }000[/latex] Fundraising [latex]\scriptsize \text{R5 }000[/latex] TOTAL INCOME [latex]\scriptsize \text{R27 0}00[/latex] . EXPENDITURE AMOUNT Donation to homeless shelter [latex]\scriptsize \text{R}6\text{ }500[/latex] Transport costs [latex]\scriptsize \text{R1 0}00[/latex] Rent [latex]\scriptsize \text{R4 }500[/latex] . TOTAL EXPENDITURE [latex]\scriptsize \text{R12 0}00[/latex] SURPLUS [latex]\scriptsize \text{R15 0}00[/latex]

Media Attributions

- Figure 1 Budget sample © DHET is licensed under a CC BY (Attribution) license

ZAR is the internationally recognised abbreviation for South African Rands